Are You Covered? Navigating Insurance for Prosthetics

A prosthetic is an artificial body part that restores function and appearance, but this vital device can also be pricey, causing many to wonder about how they can afford it.

The good news is that most insurance providers cover prosthetics to some degree. However, to minimize the costs you have to pay while still ensuring you meet your prosthetic needs, it is crucial to understand what your insurance covers for your specific scenario.

We have compiled a comprehensive guide to help you navigate the prosthetic insurance coverage elements and terminology.

The Types of Prosthetics and Their Costs

Insurance Providers and Prosthetic Coverage

While the amount of coverage will differ based on your insurance plan, most plans will cover prosthetics to at least some degree. Knowing this, it’s essential to understand your insurance coverage so there are no surprises regarding what you are expected to pay for your prosthetic.

For more specific cost details, you can refer to our helpful guide on how much a prosthetic leg costs.

Public Insurance Options: Medicare and Medicaid

For those with Medicare, both the doctor and artificial limb supplier must be enrolled in the program, which uses the K-level to determine the type of prosthetic that will be covered. This system is how the Centers for Medicare & Medicaid Services (CMS) deems a prosthetic device medically necessary.

You must first meet your Part B deductible, but after Medicare deems a prosthesis medically necessary, you will be responsible for only 20% of the Medicare-approved prosthetic amount, and Medicare will cover the rest.

As for Medicaid, coverage is provided for specific devices, and the extent of coverage can vary from state to state. If you have Medicaid, you will want to check your local laws to see if Medicaid coverage is available for your desired prosthetic type.

Coverage for Medicaid is based on medical necessity, like Medicare, but there are also limits on the type of the prosthetic covered. Your prosthetic team can help you work with your Medicaid coverage to find the best prosthetic for you.

Private Insurance Options: Employer-Sponsored Plans and Individual or Family Plans

The Affordable Care Act (ACA) requires that all small group insurance plans, which include employer-sponsored insurance and individual/family plans obtained through the marketplace, must cover Essential Health benefits, which include prosthetics. Because of this, those with these types of insurance may find that their insurance covers a higher percentage of their bill.

An exception to this is those who work for a large corporation, as the law does not require these insurance plans to offer coverage for prosthetic limbs. Still, some plans may provide coverage.

Key Terms in Prosthetic Insurance Coverage

When it comes to looking into your insurance coverage for a prosthetic, you can expect to see many terms thrown around. Let’s take a look at what some of these common terms mean and how they relate to the cost expected of you.

Deductibles And Coinsurance

A deductible is the amount of money you are expected to pay out-of-pocket before your health insurance begins kicking in.

Deductibles can vary based on the insurance plan, with some plans having a low monthly premium but a high deductible. So, it is important to look into this number when considering a prosthetic.

Once the deductible has been met, coinsurance applies. Coinsurance is often given as a percentage, so a 20% coinsurance means you are responsible for 20% of the remaining costs for the prosthetic, and your insurance provider will cover the remaining 80%.

In-Network Vs. Out-Of-Network Providers

One thing that affects the amount many insurance plans cover is if you see an in-network or out-of-network provider. Generally, insurance companies will pay less if you see an out-of-network provider and, in some cases, may not cover the cost for these providers at all. Look into your insurance plan to see their stance and coverage details based on the provide

Tips for Maximizing Insurance Coverage for Prosthetics

Are you seeking to maximize your insurance coverage for prosthetics? Below are some tips to guide you through the process.

Understand Your Policy’s Specific Benefits and Limitations

The first critical step in dealing with insurance is to understand the specifics of your policy, like the percentage of a prosthetic they cover, differences in coverage for out-of-network and in-network providers, and coverage caps.

This knowledge will empower you to collaborate effectively with your prosthetist, enabling them to recommend a prosthetic that fulfills your needs while remaining within your policy’s boundaries. This approach minimizes your out-of-pocket costs.

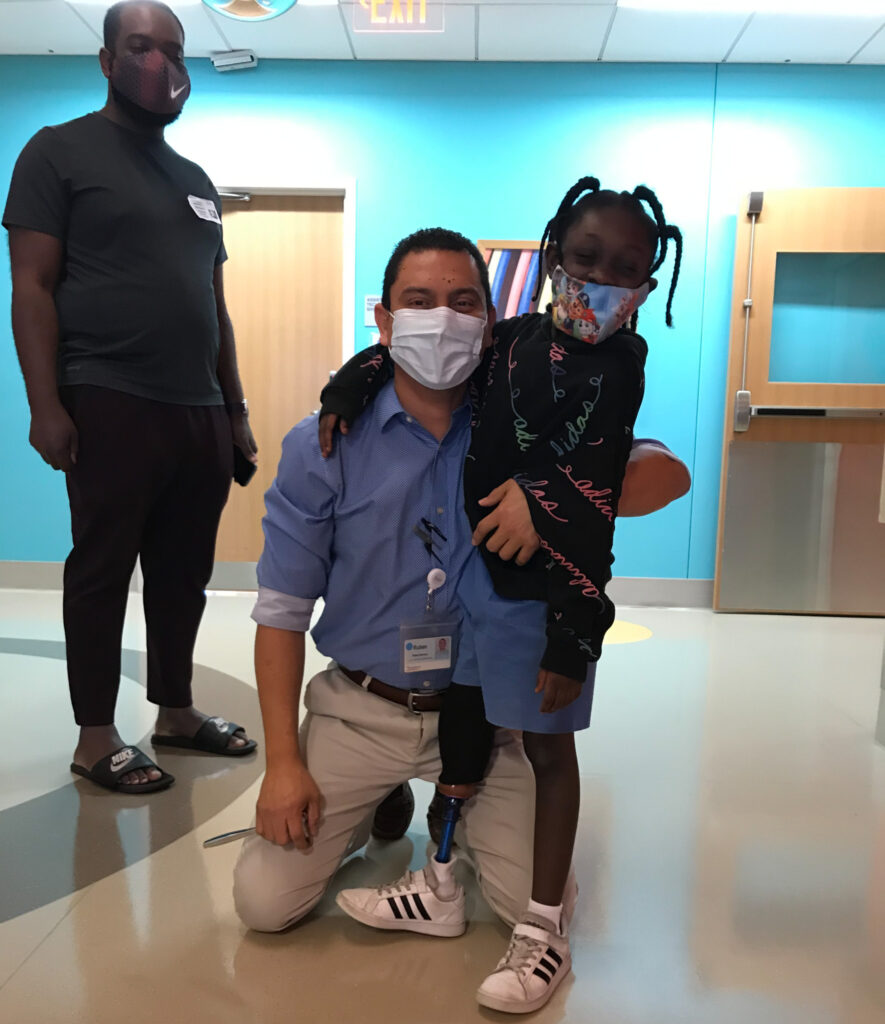

Lawall Prosthetics and Orthotics: Your Trusted Advocate

At Lawall, we’re committed to assisting you throughout the process. Our team will help you obtain necessary authorization and documentation from your care team, and we will actively advocate for you should there be any denials. However, while we are fervent supporters, it’s crucial to remember that you are your best advocate.

Work Closely with Your Prosthetist and Insurance Company

Open communication with your insurance company can prove beneficial. Be proactive in understanding what your plan covers and any limitations on the type of prosthetic allowed. Armed with this information, your prosthetist at Lawall can match you with an appropriate prosthetic that fits your insurance coverage and your needs.

Remember, identifying the right prosthetic is a team effort. The collaboration between you, your insurance company, and your prosthetist ensures that financial considerations do not hinder your pursuit of the best possible solution.

Support From National and Local Organizations

Several organizations are continually advocating for better access to prosthetics. The American Orthotic & Prosthetic Association (AOPA) and the Affordable Care Act (ACA) have worked tirelessly to secure rights and access for all patients. Additionally, local state orthotic and prosthetic organizations lobby for legislation that ensures all patients have access to suitable prosthetics.

A notable movement is “So Kids Can Move,” which initially focused on children but has since expanded to advocate for people of all ages to have appropriate access to prosthetic care. By supporting these organizations and initiatives, you’re contributing to a wider effort that strives for improved prosthetic care accessibility for everyone.”

Seek Pre-Authorization and Obtain Any Required Documentation

Some insurance providers, such as Medicare, require pre-authorization, which is the process of submitting a request for the prosthetic before receiving the prosthetic or submitting the claim. Pre-authorization aims to ensure that all applicable Medicare coverage, coding rules, and payments are met before the prosthetic is created to lessen any problems from occurring later down the line.

To maximize insurance coverage and ensure you are not stuck paying more than expected, be sure to reach out to your insurance company and enquire about any need for pre-authorization.

Navigating Insurance Appeals and Denials

In some cases, your claim for a prosthetic may be denied, often because the insurance company needs to understand why the prosthetic is needed and what makes it a medical necessity. When appealing the denial, you will want to focus on addressing these areas.

The good news is that you can appeal a denial, and here are some steps to take:

– Write a letter to the insurance company, listing the challenges you face every day.

– Ask your doctor to write a letter to the insurance company describing challenges, skin scarring, and pain.

Conclusion

When it comes to prosthetics, their cost is a significant consideration since they can set you back thousands of dollars. However, insurance can help.

To make the most of your insurance coverage, it is important to understand the terms of your insurance, including if they cover prosthetics and how much you will be expected to pay.

Furthermore, optimal coverage and care will only be achieved if you actively engage with your insurance provider and prosthetist so that everyone can work together to find you a prosthetic that meets your needs and minimizes out of pockets costs.

If you have any other questions about prosthetist insurance coverage, Lawall Prosthetics & Orthotics is here to help.

References

Prior Authorization Process for Certain Durable Medical Equipment, Prosthetics, Orthotics, and Supplies (DMEPOS) Items | CMS. (2023). https://www.cms.gov/Research-Statistics-Data-and-Systems/Monitoring-Programs/Medicare-FFS-Compliance-Programs/DMEPOS/Prior-Authorization-Process-for-Certain-Durable-Medical-Equipment-Prosthetic-Orthotics-Supplies-Items

Prosthetic Coverage. (2023). https://www.medicare.gov/coverage/prosthetic-devices